For the purpose of this example, let’s make some assumptions:

- Solar Installation Cost: The cost of installing a solar farm can vary widely, but as of my last training cut-off in 2021, a typical cost for utility-scale solar farms in the U.S. was around $1,000 to $1,500 per installed kilowatt (kW). For our example, let’s assume a solar farm capacity of 1 MW (1,000 kW) for 1 acre and a cost of $1,250 per kW. That’s a total cost of $1,250,000.

- Monthly Maintenance and Other Operational Costs: Let’s assume monthly maintenance, insurance, and other associated costs are approximately $1,500.

- Solar Farm Performance: On average, the capacity factor for solar farms in the U.S. is about 25%. This means that over the course of a year, the solar farm produces at about 25% of its maximum capacity. So, a 1 MW solar farm would produce about 250 kW on average.

- Electricity Pricing: The price at which you can sell the solar electricity will significantly impact ROI. This depends on the prevailing market rates, any Power Purchase Agreements (PPAs) in place, and other regional factors. Let’s assume a selling price of $0.05 per kWh.

Given these assumptions:

Monthly Earnings:

- 250kW ∗ 24 hours/day ∗ 30 days/month = 180,000 kW hours per month

- Monthly Revenue: 180,000 kWh * $0.05/kWh = $9,000

- Monthly Costs: $1,500

- Monthly Net Profit: $9,000 – $1,500 = $7,500

Yearly Earnings:

- 250kW∗24hours/day∗365days/year=2,190,000kWh/year

- Yearly Revenue: 2,190,000 kWh * $0.05/kWh = $109,500

- Yearly Costs: $1,500 * 12 months = $18,000

- Yearly Net Profit: $109,500 – $18,000 = $91,500

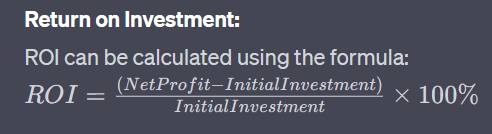

Return on Investment: ROI can be calculated using the formula:

Using the first year’s net profit: ROI = \frac{($91,500 – $1,250,000)}{$1,250,000} \times 100% = -92.88%

This means you’d have a negative ROI in the first year, which is to be expected given the initial capital investment for the solar panels. It would take multiple years of operation to reach a positive ROI. Using the yearly net profit figure above, it would take approximately \frac{$1,250,000}{$91,500} \approx 13.65 years to break even. After that, the solar farm would begin generating a positive ROI.

Note: These figures are purely illustrative and based on assumptions. For a detailed and accurate analysis, you’d need real-world figures, including any local incentives, tax credits, grants, or rebates available in South Carolina or other specific areas.

prompt engineuro: OpenAI

copy/paste

write analysis for return on investment with monthly and yearly earnings for a 1 acre solar farmstay up to date with Inner I Network;